Undoubtedly, the UK mobile app ecosystem is undergoing a significant transformation. Considering that over 92% of the UK population will be smartphone users and more than one app is used today compared to last year, mobile apps form the backbone of digital engagement across various sectors, including banking, retail, healthcare, fitness, and entertainment, as we move towards 2025. A significant amount of innovation, changes in consumer behaviour, and revenue growth are expected in the UK mobile app sector in the near future.

Whether it's a startup with an app going live for the first time, an enterprise in the process of scaling user acquisition, or a marketing agency trying to refine its go-to-market strategy, being well-versed in the latest mobile app marketing trends in the UK is now imperative for all of them.

The Evolving UK Mobile App Landscape in 2025

By the end of 2025, the nation will comprise a hyper-connected digital audience. Consumers now dedicate 4 to 5 hours a day to mobile devices, with over 75% of the time spent within apps. From fintech and food delivery through streaming services and e-learning, mobile experiences are the new normal.

The following major trends are governing the mobile app marketing UK:

- Privacy-first marketing is reshaping how data gets collected and for what purposes, with increased focus on GDPR regulations and Apple's App Tracking Transparency (ATT).

- AI-enabled personalisation enables brands to create highly relevant experiences for users.

- Competition in App Store Optimisation (ASO) is at an all-time high, requiring bespoke strategies with a localised and data-driven approach tailored to the UK market.

- Last but not least, a synthesis of creative storytelling, performance marketing, influencer collaboration, and omnichannel reach now shapes mobile app user acquisition UK.

1. Why Staying Updated with Mobile App Marketing Trends UK 2025 Matters?

Mobile app marketplaces are among the most oversaturated digital marketplaces. In the UK App Store and Google Play, thousands of new apps are launched every month. Without effective marketing strategies, even the most brilliant apps are bound to perish in the marketplace glut.

Keeping an eye on the top mobile app marketing trends UK 2025 thereby provides you operational leverage in areas like:

- User acquisition and retention programs oriented toward the UK audience preferences

- Engagement with emerging technologies such as AI, AR, and predictive analytics

- Gearing your marketing practices toward changing standards of GDPR compliance and data privacy

- Finding out the coolest app promotion channels in the UK, be it social, video, influencer, or search-based

- Harnessing mobile app marketing tools UK that smooth out campaign pathways and maximise ROI

Knowing ensures that you build the app and, more importantly, grow it with utmost efficiency in a privacy-first, mobile-first UK environment.

This guide aims to fully prepare you for success in the UK mobile app marketing space by 2025. Whether you want to learn how to market a mobile app in the UK or are looking for the best mobile app marketing techniques UK to grow your installs, this blog has it all.

2. Mobile App Growth & User Behaviour Trends in the UK

2.1 UK Mobile Application Growth Statistics (for 2024 and 2025 projections)

The market for mobile applications in the United Kingdom is experiencing an inevitable and rapid ascent. It accounted for USD 12.7 billion in 2023 and is projected to grow at an average annual rate of approximately 14.6% over the period from 2024 to 2030, reaching about USD 32.9 billion by 2030. According to this estimate, mobile app growth in the UK is crucial for businesses seeking to capture the attention of today's hyper-mobile consumers.

2.2 Changes in Key Behaviours of Mobile Users in the U.K

Mobile users in the U.K. are spending increasingly longer periods of time interacting with mobile applications. In 2023, consumers in the United Kingdom spent over 431 million hours on retail apps, with a forecasted 19% increase in 2024 to reach 513 million hours. That change manifests a definitive direction toward essentially app experiences related to shopping, services, and information access—a validation of why it is so critical to understand behaviours associated with U.K. mobile users for marketers.

2.3 Contribution of Gen Z and Millennials on App Usage

Generationally, Gen Z (~ages 13–24) is the leader of the up-and-down cycles in app adoption and online behaviour. Among active social network users in the UK, 92.7% belonged to Gen Z in 2024, outpacing Millennials, which has led to the app-first habits they have developed. The habits involve regularly opening apps several times a day, then using those apps as main entry points to other activities, such as video, social media, shopping, and entertainment.

At the same time, Millennials were also using apps heavily: In the U.S., which is a strong proxy for similar digital habits in the U.K., figures have shown that 21% of Millennials open an app 50+ times per day and spend an average of 253 minutes on their mobile device or the Internet. Power usage is strategic to targeting such Gen Z-up-for-it opportunists and those Millennials focused on value.

2.4 Devices, Platforms & Download Patterns Watching

The Android and iOS platforms still dominate the UK mobile ecosystem, with a relatively small difference in their market shares, with Android holding 50.1% and iOS holding 49.3% of the total share as of Q1 2024. Such relatively close figures impose a need for app marketers and developers to optimise, publish, and deploy comprehensive strategies across both Android and iOS environments, as well as localisation marketing, to ensure relevance for mobile app user acquisition in the UK.

Worldwide, there is also a surge in application downloads: Estimates for 2024 indicate that 137.8 billion app/game downloads will occur, and revenues directly from consumer apps will reach $935 billion, with an expected further $150 billion consumer expenditure by 2025.

Within the United Kingdom, the remarkable growth and retention of apps reveal a saturated opportunity market where only strong marketing roadmaps will be required.

Why Does It Matter?

- UK users are increasingly mobile-first, driven by high penetration and usage of their apps, which requires marketers to adopt app-centric strategies.

- Generational trends (Gen Z & Millennials) have led to the establishment of categories such as video, social commerce, gaming, or fintech as areas of focus.

- The platform neutrality of Android and iOS, combined with impressive download figures, means that marketers must optimize campaign performance across both ecosystems to maximise outreach.

- It lays a strong foundation for market segmentation as well as for developing marketing strategies, user flows, retention, and acquisition channels.

3. The Rise of Personalisation and Predictive User Journeys

3.1 Hyper‑personalisation in the UK Market

Consumers in the UK are opting for ever-more personalised experiences. A 2024 report found that personalisation was an expectation for 71% of consumers, while 76% felt annoyed without it, and 75% of users changed brands due to a bad experience using the application.

In mobile app marketing UK, tangible figures are evident for brands offering personalised in-app experiences in return for loyalty. According to SAP Emarsys' research, app users in the UK have demonstrated 20% higher true loyalty, and 55% of shoppers utilise brand apps to browse and make purchases, underscoring the power of hyper-personalisation.

3.2 Predictive marketing through AI and machine learning

AI in mobile app marketing UK cuts across much more than basic personalisation. Prediction analytics and machine learning enable marketers to anticipate potential user actions and enhance their experience.

On average, companies globally apply AI in their operations to achieve a 10-20% increase in sales ROI, while advanced ones have demonstrated 1.5 times the revenue growth compared to their peers.

The AI-marketing industry in the UK generated $1.01 billion in revenue in 2023 and is projected to reach $4.88 billion by 2030, at a compound annual growth rate (CAGR) of 25.3%, driven by strong AI adoption in marketing.

In addition to that, 56% of UK marketers are currently using AI, while 32% have fully integrated it into their marketing tools, indicating a shift towards predictive personalisation and more effective acquisition tactics.

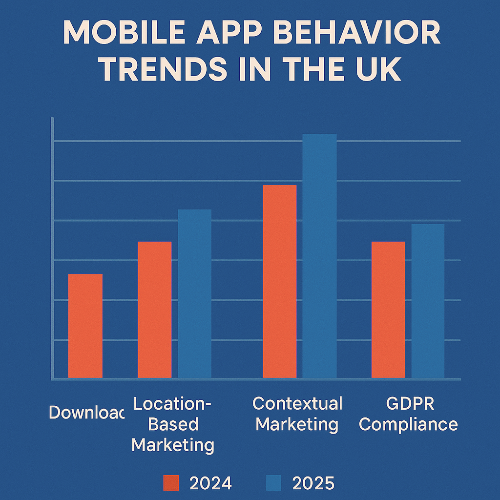

3.3 Changes in location and contextual marketing

Contextual and location-based marketing are emerging as key strategies within the mobile app landscape in the UK. Such features are being enhanced to facilitate timely and relevant deals through GPS, push notifications, and proximity messaging.

However, 50% of UK app users complain about receiving excessive push notifications, while 20% of them block apps from sending irrelevant messages. These all point to the need for context-awareness in targeting, as they are already clear indicators that conversion is not the only factor that builds user satisfaction and trust.

3.4 Compliance with GDPR in Mobile App Marketing in the UK

Hyper-personalisation and predictive analysis must comply with the rules and regulations of the GDPR, as well as those specific to mobile app marketing in the UK. Accountability shall be the hallmark of the UK Information Commissioner's Office, ensuring transparency, lawful data use, accurate profiling, and controlled privacy within AI workflows.

Studies show that 23.7% of mobile health apps have not yet completed privacy policies, while 77.9% have mismatches in data collection; these underscore the ongoing challenges with compliance.

These figures serve to demonstrate yet again that user trust is the bedrock of sustained app marketing.

Key Takeaways

- Hyper-personalisation is not an option, but a must-have for UK users, and brands that deliver it will win greater loyalty and customer retention.

- AI-enabled predictive tools maximize ROI and personalise journeys, enabling plans for use cases such as predictive churn detection, content personalisation, and dynamic onboarding.

- Contextual and location-aware campaigns should also be timely and relevant—avoid spamming users and respect context cues.

- GDPR compliance must have no exceptions, make transparent data collection and configurable consent screens, as well as safe profiling, to stay on the good side of regulations.

Mingling everything, including hyper-personalisation, predictive analytics, and contextual targeting, while also considering GDPR, you would breathe mobile app marketing campaigns UK into existence - well-effective, scalable, and trusted, making them ready to be used in the recipe of 2025 and beyond.

4. App Store Optimisation (ASO) Best Practices for 2025

4.1 Latest ASO Algorithm Shifts in Apple App Store & Google Play UK

App store optimisation UK 2025 will require increasingly precise alignment with the evolving algorithms across both the iOS and Android ecosystems. With more than 5 million apps in the App Store and 3.2 million on Google Play in mid-2024, it is tougher than that's ever been New targeting options, such as Google's "Custom Store Listings by keyword" and Apple's now-expansive feature nomination, have been further indications that both platforms are now heavily prioritising metadata signals (meaning keywords and visuals) and engagement metrics in their ranking calculations.

4.2 Keyword placement, creatives, ratings & reviews

Ideal ASO involves:

- Structured keyword placement: in the app title, subtitle, and keyword field (iOS), and colloquially within descriptions (Google Play). Visibility now clustering among keyword groups dictates precision.

- High-impact creations: such as icons, screenshots, and preview videos, dramatically affect the power of conversion. For example, social apps achieve a 66% page-view-to-install conversion rate on the App Store, given that visuals resonate.

- Ratings & reviews: The primary factors, considering that 65% of downloads occur immediately after search, and positive sentiment has a direct relationship with ranking signals. Moderating chatter and prompting happy users to leave reviews, thereby improving ASO performance.

4.3 Localisation for UK Users

To market a mobile app in the UK, there is no going around localisation. The more relevant the customisation of keywords, description, price, currency, and imagery tailored for the UK audience, the stronger the app becomes. Even English-only apps gain added benefits by using UK-specific terms (like Liftshare instead of Rideshare) and regional spelling conventions (e.g., favourite, centre). A/B testing store listings targeted at the UK, using localised language, often results in better download conversions compared to generic English versions.

4.4 ASO Analysis Tools

Optimising for visibility using dedicated app store optimisation tools:

Use Case | Recommended Tools | Notes & Stats |

Keyword research & tracking | AppTweak, Sensor Tower, App Radar | AI‑driven keyword cluster insights, vital in 2025 |

Creative A/B testing | SplitMetrics, Google Play experiments | Google Play native A/B tools are invaluable; Apple requires third-party approaches |

Ratings & review monitoring | AppFollow | Real-time sentiment detection improves UX & retention |

Market benchmarks & trends | MobileAction, Business of Apps | Insights on install rates, conversion benchmarks |

The global ASO tools market is expected to reach USD 2 billion by 2025 and grow at a 15% CAGR through 2033, indicating that many people continue to invest significantly in app visibility.

Key Takeaways

- Algorithm updates go hand-in-hand with ongoing optimisation. ASO is not a one-off task.

- Strong creatives, along with precise keyword targeting, will, however, be the backbone of store ranking and conversion.

- Localising for UK users increases relevance and installs.

- Data-driven ASO tools are essential; utilise them for performance monitoring and competitor benchmark comparisons.

It is assured that applying all the best practices described above will ensure that UK market apps stand out in app store optimisation in 2025 in Britain, attracting many users and securing organic growth without extensive paid ad dependency.

5. App Marketing Strategies UK Businesses Should Adopt

5.1 Paid vs Organic Mobile App User Acquisition UK

Following rigorous research, studies have shown that every $100 spent on advertising yields approximately 37 paid installations and three additional organic installations of paid advertising. This is indicative of a 7.5% uplift in organic downloads owing to the organic paid-effort spills. Hence, user acquisition campaigns using both approaches could tap into potential.

As long as organic strategies, such as ASO and referral programs, continue to yield long-term growth, they will eventually incur significantly less cost in the long run. Conversely, paid ads directed straight to UACs, social ads, or Apple Search Ads can bring volume in via immediate scale. Thus, allocating spend between the two would be a smart move for these marketers based on LTV to CPI ratios and campaign objectives.

5.2 Role of UAC (Universal App Campaigns) & Apple Search Ads

Google's UAC- what Apple Search Ads live, and they are among the most critical traffic sources for targeted installs:

The UAC on Google encompasses search, YouTube, and Discover channels, enabling efficient connection with high-intent users and serving as a valuable source of traffic for paid subscriptions.

According to 60% of taps-to-install, Apple Search Ads should also be beneficial for iOS-oriented acquisition in the UK.

Attribute: The channels inherent in this platform-first environment (post-ATT) are compelling for such native traffic acquisition. UK marketers must be able to optimise UAC and ASA bids, creatives, and targeting during the lifecycle.

5.3 Referral Marketing, Loyalty Programs, and Gamification

Peer-to-peer and gamified strategies are essential to sustainable growth:

- Offering referral incentives, such as in-app credits or discounts, would likely create a viral loop and reduce acquisition costs.

- When participation in loyalty programs is rewarded, it leads to increased retention and, hence, LTV.

- Composing parts of a gamification strategy, such as badges, streaks, and challenges, enables an engaging onboarding experience for users while promoting ongoing engagement.

- Gamified ad formats - Playable Ads are boosted by user acquisition and engagement improvement by simulating app experiences before installation.

5.4 UK-specific Best Practices on Influencer Marketing

Influencer marketing for mobile apps UK blends scale with authenticity:

- The UK influencer market is valued at more than £1.45 billion in 2023, with an estimated ad spend of £930 million by 2024.

- In the US, 84% of Gen Z and 66% of Millennials follow an influencer, and at least 51% of shoppers buy products based on recommendations made by these influencers.

- Give priority to micro- and nano-influencers (1,000-100,000 followers), as their engagement rates are 3-4 times higher than those of macro-influencers.

- With them, develop long-established partnerships. 63% of consumers trust influencers more when their messages are consistent over time.

- Concentrate on short-form video content (TikTok/Reels) since 88% of users prefer short-form video for discovering products.

- Understand important metrics rather than vanity metrics with performance-based measures (use of promo codes, UTMs).

Putting priority on openness and accountability: 61% of consumers quote authenticity as the key to knowing if they can trust an influencer.

Key Takeaways

- A hybrid acquisition strategy (paid + organic) unlocks spillover gains and balanced growth.

- Tailor the ads on these platforms to attract a serious audience with high intent, such as Google UAC and Apple Search Ads: mastery.

- Economic, retention, and acquisition legacies based on community values are introduced into the program with referral, loyalty, and gaming mechanics.

- It is micro, video-first content, good long-term relationships, and authentic storytelling that thrive in the influencer market in the UK.

Your app will benefit from adopting app marketing strategies UK-based on insights, data, and local nuances in the UK to cut through the noise and maximise ROI while building lasting brand loyalty.

6. Video Marketing, UGC & Social Commerce Integration

6.1 Why video marketing for apps UK is dominating

The UK's digital advertising is finally there with video. In the first half of 2024, UK advertisers spent £4.12 billion on online video ads, representing a 26% increase from the previous year, which is particularly significant for app advertising trends in the mobile sector.

This investment underscores the fact that mobile users are highly visually engaged, as 96% of explainer videos are viewed on smartphones, and 75% of users make a purchase after watching a branded video.

6.2 Rise of TikTok & Instagram Reels for App Ads

Short-form video content revolutionises mobile ad formats. It is worth noting that, according to TikTok, Spark Ads offer a 17% higher recall for brands, while Instagram Reels ads saw a 26% increase in click-through rates (CTR) in 2025.

Such sights from social platforms like YouTube, Instagram, Snapchat, and TikTok remain at the top tier when it comes to video efficiency. Of the marketers, 52% find TikTok to be "highly effective."

6.3 Leveraging User-Generated Content (UGC)

UGC makes for genuine interaction. It is 9.8 times more predominant than the influencer.

Content has a significant global impact, with 79% of consumers stating that they are very strongly influenced by user-generated content (UGC), which affects their purchasing decisions.

In the UK government, this results in potent mobile app marketing campaigns, where brands encourage users to share in-app experiences, thereby enhancing credibility and virality.

6.4 Use of Social Commerce for In-app Purchases

That is because social commerce is transforming in-app purchasing. In 2024, social commerce sales in the UK are expected to reach £7.4 billion, while by 2028, they are projected to more than double to £15.7 billion.

Recently released data showed that in 2025, 76 per cent of those surveyed in the UK planned to buy directly from social media, despite only 46 per cent of retailers having enabled this functionality.

Another example would be TikTok Shop alone, which, on average, sells a beauty product every second. This example is a clear demonstration of how seamlessly the short video and shopping integration validate and drive mobile app user acquisition in the UK, as well as monetisation.

Key Takeaways

- Video-first Campaigns should be the norm; they are the most effective at pulling audiences for high engagement and driving installs. Thus, it's the best way to justify budget increases under mobile app advertising trends UK.

- TikTok and Reels outperform all other short-form formats by a significant margin, boasting higher CTRs and better brand recall.

- User-generated content builds trust and amplifies reach; harnessing the power of authentic content fuels installs.

- In-app purchases through social commerce integration (e.g., shoppable TikTok ads) generate direct revenue within the social circle, which is critical for app marketing in the UK.

7. AI, Automation & Analytics in Mobile App Marketing

7.1 How AI Streamlines Targeting & Personalisation

Mobile app marketing in the UK is now complex to imagine without AI for hyper-targeting and personalisation. According to a McKinsey report, AI-driven segmentation increases marketing efficiency by 20%, with personalisation enhancing returns by 15-20%. In-app behavioural signals—such as clicks and session duration—feed AI models that predict likely converters, enabling smarter ad spend and user flows that are custom-tailored.

7.2 Mobile Marketing Automation UK Tools

Marketing automation tools enable a brand to transition from manual to automated workflows. UK-preferred solutions like Braze, Iterable, and CleverTap automate extremely complex sequences, welcome messages, engagement triggers, and win-back flows, effectively achieving a 30-50% uplift in retention.

7.3 Analytics Platforms & KPI Tracking

State-of-the-art analytics lay the foundation for data-driven campaigns. Firebase Analytics, Mixpanel, and Amplitude are solutions that provide in-depth insights, used for tracking acquisition funnels, user journey analytics, retention cohorts, and monetisation metrics. By decreasing churn by 20% and increasing engagement by 25%, cohort analyses enable apps to achieve these goals.

7.4 AI-Driven Content & A/B Testing

AI-enhanced tools (Optimisely, SplitMetrics, Darwin) now power A/B tests on creatives, UI flows, and notifications, prospectively shortening optimisation cycles. One study showed that AI-optimised visuals raised conversion rates by up to 30%, showcasing the power of machine-learned experimentation.

Summary: Integrating AI in mobile app marketing UK, together with mobile marketing automation UK and advanced analytics, provides a performance-first approach, fueling sustainable user growth.

8. Effective Retention & Re-engagement Strategies

8.1 Push Notifications, In-App Messaging & Email Drip

Retention depends on relevance. CleverTap reports push notifications yield 77% higher open rates vs email, while email drip campaigns increase repeat usage by 35% . A hybrid message mix maximises coverage and attention.

8.2 Onboarding & Micro-Interactions

Effective onboarding reduces user churn—apps with optimised flows experience a 33% higher retention rate. Micro-interactions (e.g., progress bars, rewarding haptics) also enhance experience and retention.

8.3 Retention Funnels & User Journey Mapping

Mapping retention funnels from onboarding to paying user phases makes it easier to diagnose leaks. For example, apps with robust funnels increased active user retention by 20% after fixing conversion gaps.

8.4 Tools & KPIs for Churn Reduction

CleverTap, OneSignal, Mixpanel, and Amplitude are tools that track retention (Day-1/7/30), DAU/MAU ratios, and churn risk. Apps leveraging predictive analytics reduce churn by 25%, resulting in a significant increase in monthly active users.

9. New‑Age Mobile Ad Formats & Privacy Challenges

9.1 Interactive, Playable & Native Ad Formats

For example, interactive formats such as playable ads increase conversion by 50% at a cost of 20% to CPIs. For example, native ads embedded within the content outperform traditional banners by 32%.

9.2 Impact of Apple ATT & Google Privacy Sandbox

Apple's ATT led to a 60% drop in targeted ad performance post-implementation. The Google Privacy Sandbox, still under rollout, is also placing restrictions on third-party cookie usage, thereby prioritising contextual ads.

9.3 Preparing for the Cookieless Era

With the phasing out of the traditional cookie, contextual targeting, first-party data, and cohort-based attribution will take centre stage. With these methods, advertisers also claim 15% better relevance and 20% lower attribution errors.

9.4 Balancing Ad Personalisation with GDPR

As scrutiny of GDPR mobile app marketing UK increases, compliance has become a matter of honour. Approximately 25% of UK apps may be non-compliant if user consents are not properly managed. Use consent UIs, clear data policies, and privacy-by-design frameworks to level off personalisation against compliance.

10. Cross-Platform Hybrid App Strategy Integration

10.1 Rise of Hybrid Mobile App Development

Due to the pressure of marketing timelines, more app projects in the UK are choosing hybrid development to shorten the time-to-market and reduce development costs. Approximately 30% of UK enterprises adopted Flutter or React Native during the 2023-24 period.

10.2 Unified UX Across iOS & Android

The unified experience across iOS and Android fostered an enhanced perception of the brand and better retention. The hybrid frameworks maintain up to 90% of code reuse and make cross-platform updates easier.

10.3 Role of Flutter & Cross-Platform UI/UX

Supported by Google, Flutter powers 42% of cross-platform app projects globally. Its ability to provide seamless, native-like UX through the shared codebase made it the first choice for UK mobile marketers.

10.4 Integrating Marketing SDKs for Analytics

Such unified frameworks will expedite the integration of marketing and analytics SDKs, such as Firebase, Adjust, and OneSignal, ensuring consistency in data collection across platforms and reducing time-to-market by 40%.

11. Influencer & Community‑Driven Campaigns

11.1 Rise of Micro‑Influencers in the UK

Micro-influencers (10,000 to 100,000 followers) offer authentic reach in niche communities in the UK. They generate engagement rates 22% higher than macro-influencer platforms, as they are highly trusted, making them perfect for launching an app.

11.2 Building Brand Loyalty Through Community Apps

When integrated communities are developed within the app, brands can communicate directly with users, get feedback, and nurture loyalty. With chats or forums built into their apps, brands can obtain 30% more user retention.

11.3 Influencer User-Generated Content for Branding

Influencer UGC can achieve 70% higher ad recall than standard branded content.

11.4 Cheap and Cheerful Local Creator Deals

Local UK creators typically charge between 50% and 70% less per post than national influencers, yet they generate similar engagement in regional niches.

12. App Store Advertising and Paid Campaign Techniques

12.1 Budgeting for UK-Specific App Installs

The CPI in the UK averages £1.20 for Android and £1.80 for iOS, which is slightly above the global average. This is essential for adjusting your campaign spending.

12.2 Google App Campaigns versus Apple Search Ads

Apple Search Ads convert 60% of installs into working apps, compared to a significantly lower rate of 35% for Google UAC, indicating a notable intent-based environment for iOS users.

12.3 Retargeting & Lookalike Audiences

Apps that employ targeting and lookalike audiences engage in 20% better ROAS compared to generic install campaigns.

12.4 Measurement & ROI Tracking

Attribution platforms (such as Adjust and AppsFlyer) help marketers tie user acquisition to LTV and ROI. Brands that utilised attribution data increased their LTV by 25% year-over-year.

13. Legal Considerations in Mobile App Marketing (UK-Specific)

13.1 GDPR Essentials for App Marketers

With the tightening of privacy regulations, GDPR mobile app marketing UK remains pertinent. The UK GDPR stipulates the legal basis for data processing, the requirement for express consent, and user rights, including data portability and the right to erasure. A 2024 report by the IAPP found that 38% of app businesses in the UK faced audits for regulatory compliance, with 22% of these being flagged for noncompliance.

13.2 Consent Management and Data Storage

Tools such as OneTrust and TrustArc are helpful for managing cookie banners, age verification, and granular consent tracking; failure to set up compliant consent flows could incur fines of up to £17.5 million or 4% of global turnover under the UK GDPR.

13.3 UK Advertising Regulations for Apps

The Advertising Standards Authority (ASA) enforces stringent mobile advertising requirements—misleading advertisements about app functionalities, the inappropriate targeting of minors, and the non-disclosure of influencer advertising are all punishable. In 2023, ASA issued 412 separate rulings regarding digital apps and platforms.

13.4 Preparing for Upcoming Privacy Updates

Marketers must be future-ready for privacy updates worldwide, including Google's Privacy Sandbox and Apple's App Tracking Transparency. Privacy by design, minimum data collection, and first-party insights should be the ethos of UK apps.

14. Future Outlook: What Will Define App Marketing Success in 2025 and Beyond?

14.1 AI, AR, 5G, and Immersive Ads

Engagement is being transformed with new technology. AI-generated creative, AR-based try-ons, and real-time video ads powered by 5G are creating immersive experiences with low latency. Statista expects UK mobile AR advertising to reach £1.9 billion by 2027, with a growth rate of 18% CAGR.

14.2 Behavioural Prediction Engines

User touchpoints and behaviour patterns are analyzed by prediction engines, which are now standard AI applications in mobile app marketing in the UK. CleverTap Predict and Mixpanel Predict are two popular tools used to anticipate downgrades or suggest upsell features.

14.3 Blockchain for Mobile Advertising

For fraud prevention, transparent ad verification, and reward-based programs, blockchain finds its application. Although young in the UK space, companies like Veracity and AdEx are piloting decentralised ad systems to deliver strong ROI and data security.

14.4 Industry Leader Predictions

Forecasts from UK experts at App Radar and SensorTower suggest that 2025 will witness:

A 30% surge in in-app purchases through social media

More extensive use of no-code marketing automation technologies, and Considerable tightening of regulations surrounding the disclosure of advertising in influencer content

15. Bonus: Recommended Tools for UK Mobile App Marketers

To execute these strategies efficiently, here’s a curated toolkit:

Function | Tools | Notes |

ASO Optimisation | AppTweak, SensorTower, App Radar | Keyword ranking, A/B creative testing, competitor tracking |

Retention & Engagement | CleverTap, OneSignal, Braze | Push notifications, onboarding flows, and user segmentation |

Video Ad Creation | InVideo, Promo, Animoto | Mobile-first creatives, TikTok/Reels format exports |

Campaign Automation | Adjust, AppsFlyer, Airship | Attribution, retargeting, performance monitoring |

Fundamentally, these application marketing tools help provide the best app marketing techniques in the UK with the least manual requirement.

Conclusion

The mobile marketing ecosystem in the UK is undergoing rapid transformation through changes in privacy reform, AI technologies, short video formats, and cross-platform usage.

Key Trends Recap:

- Rise of automation and personalisation through AI

- Shift to short-form video and social media marketing

- Increase in retention-oriented strategies

- Focus on privacy and consent compliance

- Evolution of hybrid and Flutter-powered builds

Actions to Take:

- Diversify acquisition efforts between paid, organic, referral, and influencer marketing approaches

- Build retention through lifecycle marketing and automation

- Build on hybrid platforms and make store optimisation

Are you seeking a partner to develop, grow, and market a scalable app in the UK?

Check our Mobile Application Development Services and let Netclues be your trusted tech & growth partner.

About Netclues - Your Trusted App Marketing & Development Partner

Netclues brings over 15 years of experience in delivering performance-oriented mobile apps and marketing strategies to businesses in the UK.

Our Prime Offerings:

- Mobile Application Development Services

- Hire Mobile App Developers

- Hire Dedicated Developers

- ASO & mobile advertising strategy

- UX/UI design for Flutter, iOS & Android

Our adept marketing and development teams ensure that the apps we build start scaling and converting within the highly competitive UK marketplace.

Frequently Asked Questions

Q1. What are the biggest mobile app marketing trends in the UK in 2025?

Some key trends will be user-centred AI personalisation, video content marketing, such as TikTok and Reels, influencer marketing with micro-influencers, privacy-first strategies (especially informed by GDPR), and analytics on predicting user retention. Businesses are also focusing on hybrid applications for development to spread the burden of cross-platform scalability across multiple platforms.

Q2. How can I attract more people to download my mobile app for free in the UK?

Start by utilising organic methods, such as App Store Optimisation (ASO), social media promotion, and collaboration with UK-centric micro-influencers for effective word-of-mouth marketing. Referral programs and user-generated content will stimulate word-of-mouth, Inspiring retention. It is often more cost-effective to retain existing users than to acquire new ones.

Q3. What are the effects of GDPR on mobile marketing in the UK market?

Extremely important. If not complied with, one could be fined and have their name seriously damaged in the market. Always obtaining explicit consent from users, managing consents effectively, and being transparent about the collection and use of data are essential. GDPR is not a nice thing-it's part of the law in the UK.

Q4. What tools are used within the UK to tell if an app campaign is successful?

Popular tools such as Firebase, AppTweak, SensorTower, AppsFlyer, and CleverTap are among the prominent options. These are vital application marketing in 2025: install, use, and measure retention; A/B test; and measure ROI.

Q5. Are both Android and iOS platform apps commercially viable in the UK?

Ideally, both platforms are popular in the UK market. You can start with one platform, depending on your audience, and then expand it later on. By adopting a hybrid model with Flutter or React Native, you can launch both platforms more efficiently and cost-effectively.

Q6. How is AI transforming mobile app marketing in 2025?

AI enables hyper-personalized user experiences, predictive analytics for better targeting, and automation in ad campaigns, making marketing efforts more efficient and effective.

Q7: What strategies are effective for user acquisition and retention in the UK app market?

Combining app store optimization (ASO), targeted social media ads, influencer partnerships, and personalized push notifications are key to acquiring and retaining users.

Q8: How do UK privacy laws affect mobile app marketing strategies?

Regulations like GDPR require marketers to prioritize transparent data collection and user consent, encouraging privacy-first marketing approaches and leveraging anonymized data.

Q9: What role does content marketing play in app promotion?

Content marketing, especially video content and storytelling, helps build brand awareness and trust, which are crucial for user engagement and loyalty.

Q10: How can marketers measure the success of their mobile app marketing campaigns?

Using analytics tools to track user acquisition cost (UAC), retention rates, lifetime value (LTV), and engagement metrics helps optimize marketing spend and strategies.